If you’re looking for a Best TapTap Send alternatives in UAE which are safe, affordable, and convenient way to send money abroad, you’ve probably heard about TapTap Send. However, since the service has recently paused operations locally, many UAE residents and expats are searching for trustworthy alternatives. Below are some of the best TapTap Send alternatives in UAE, all reliable, regulated, and designed to make your international transfers simple and stress-free.

Careem Pay – Best Overall TapTap Send Alternative in the UAE

Careem Pay has quickly grown into one of the most widely used money transfer options across the Emirates. Since most UAE residents already use Careem for rides and food delivery, sending money directly from the same super app is extremely convenient.

Careem Pay supports transfers to Pakistan, India, Jordan, Egypt, the Philippines, and more, with competitive exchange rates and quick transfers. The service is regulated in the UAE and trusted across Dubai, Sharjah, and Abu Dhabi.

Pros:

- Easily send money through the same Careem app you use daily

- Strong rates + fast delivery

- Trusted across Dubai, Abu Dhabi, Sharjah

- Simple onboarding

Cons

- Limited supported countries (but expanding)

- Daily transfer limits may apply

Tabby – Send Now, Pay Later for Emergencies

Tabby is known for Buy Now, Pay Later (BNPL), but many UAE users don’t know that the platform now also supports wallet features that help with payments, payouts, and remittance-style transfers depending on the service rollout. It’s ideal if you need flexible payment management for transfers or bills.

Tabby isn’t a traditional remittance app, but it works as a short-term financial workaround for users who need to manage funds before sending money abroad through other channels.

Pros:

- Excellent for emergencies or temporary cash flow gaps

- Widely used across the UAE

- Easy KYC and fast wallet setup

Cons:

- Not a direct remittance app

- Charges and limits vary based on use case

- Not ideal for regular international transfers

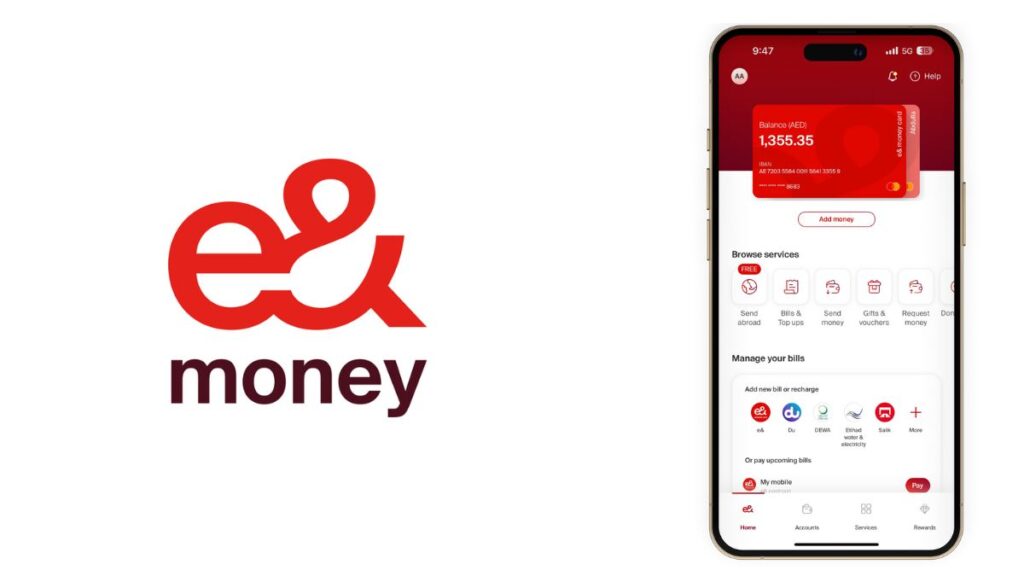

e& Money – UAE-Regulated and Very Reliable

e& Money (formerly Etisalat Wallet) is one of the fastest-growing digital wallets for international money transfers. You can send money to over 200 countries, with cash pickup, bank deposit, and mobile wallet options.

Hey there! I’ve invited you to send money abroad with e& money! Use my code MUH251903 during your first transfer over AED 500 and earn AED 20 cash rewards.

Pros:

- Works smoothly across UAE regions

- 200+ countries supported

- No registration fee or minimum balance

- Backed by e& (Etisalat), a trusted UAE brand

Cons:

- Exchange rate changes by destination

- Customer support may sometimes be slow

Al Ansari Exchange – Trusted UAE Brand With Hundreds of Branches

Al Ansari is one of the oldest and most trusted remittance services in the UAE. With branches in Dubai, Abu Dhabi, Sharjah, Ajman, RAK, UAQ, and Fujairah, it’s perfect for users who prefer physical locations.

Their app offers online transfers, but many users still appreciate the in-person service.

Pros:

- Extremely reliable and UAE-regulated

- Perfect for cash deposits and cash pickups

- Multiple payout methods

Cons:

- Higher fees than digital-only apps

- Exchange rates not always the best

- Crowds during peak hours

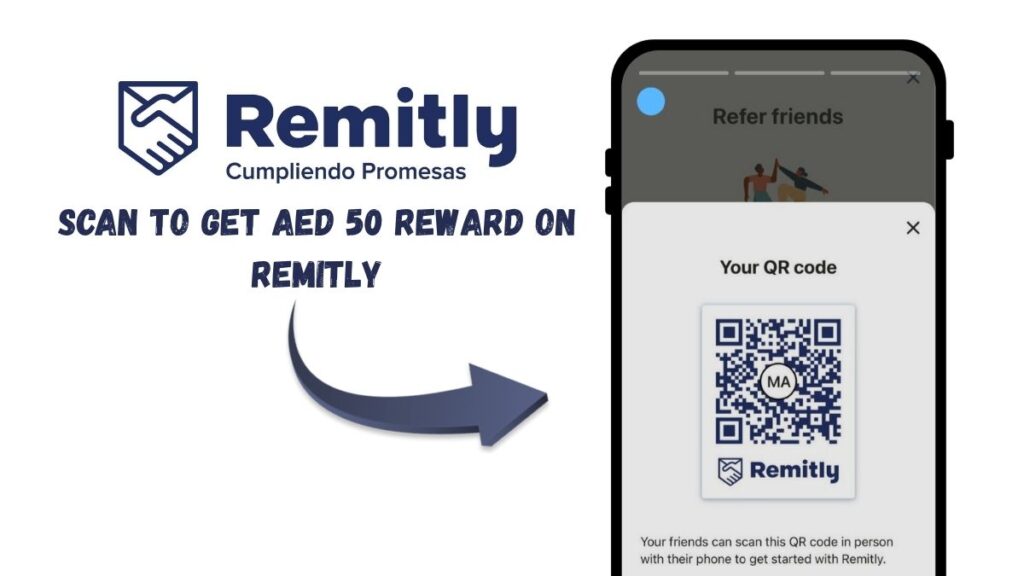

Remitly – Fast Transfers + Referral Bonus

Remitly is one of the best alternatives for users who want fast delivery, cash pickup, or wallet transfers. It’s widely used by expats from Pakistan, India, the Philippines, Nepal, Kenya, and Bangladesh.

You can also scan the QR code in the image to get your AED 50 Remitly bonus right away, super quick!

Benefits:

- Excellent exchange rates

- On-time guarantee (or they refund your fees)

- Real-time transfer tracking

- Low and transparent fees

Pros:

- Fast transfers, often instant

- Great for bank transfers + cash pickup

- Very user-friendly

Cons:

- Fee discounts apply only on first transfer

- Exchange rates vary by destination

Wise (TransferWise) – Best for Bank-to-Bank Transfers

Wise is globally trusted for its transparent fees and real mid-market exchange rates. It remains one of the cheapest ways to send money abroad from the UAE—especially to the UK, India, Bangladesh, and the Philippines.

Pros:

- Real mid-market exchange rate

- Clear pricing with no hidden fees

- Fast bank transfers

Cons:

- No cash pickup

- Requires full verification

- Limited UAE corridors

How to Choose the Best TapTap Send alternatives in UAE

Finding the right app depends on your destination, cost preferences, and urgency. Before you send:

- Check your destination country and payout method. Some apps specialize in certain corridors like India, Pakistan, or the Philippines.

- Compare total costs. Always look at both the transfer fee and exchange rate.

- Consider speed. If you need instant delivery, Careem Pay or Botim Money may be your best bet.

- Review UAE regulation and support. Choose apps that comply with Central Bank of the UAE rules for peace of mind.

- Confirm your payment options. Some apps need a UAE bank account; others accept debit or salary cards.

- Keep a backup. Since TapTap Send paused operations in the UAE, it’s smart to have at least one or two alternatives ready.

Bonus: TapTap Send Referral

Even if TapTap Send is paused in the UAE, keep this for when it restarts: Check out Taptap Send.

I use it to send money to Pakistan. Redeem code MUHAMMAB2892 and get AED 15 when you send AED 200 or more.

Final Thoughts

Finding a reliable TapTap Send alternative in the UAE is now easier than ever. Whether you prefer the convenience of Careem Pay, the flexibility of Tabby, the reliability of e& Money, or the global coverage of Wise and Remitly, each option offers something unique.

Always compare exchange rates, transfer fees, and delivery times before sending money. And if you want extra savings, use the referral bonuses included above—they genuinely help reduce transfer costs.

18 biggest X (Twitter) Spaces in 2023 (Updated)

18 biggest X (Twitter) Spaces in 2023 (Updated)

![20 biggest X (Twitter) Spaces in [year] (Updated) 2026 14 Biggest X (formerly Twitter) Spaces in history](https://noobspace.com/aglynyst/2023/08/biggest-x-spaces-twitter-120x86.jpg)